Benefits

Reliable APIs for underwriting, risk assessment and collections that lets you make informed

decisions.

RiskGauge

Your Bank Statement Analyser for accurate and low-cost credit decisioning

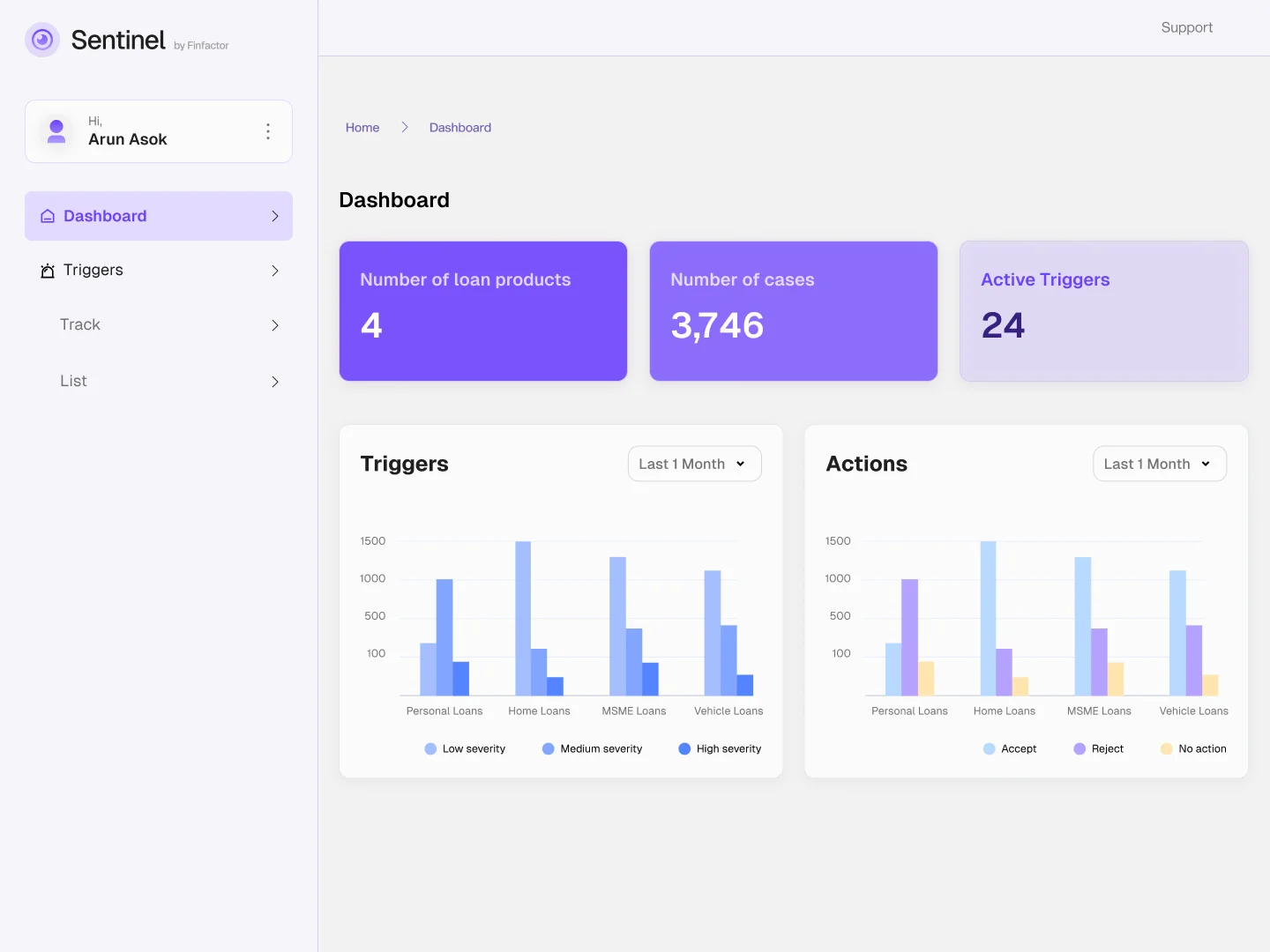

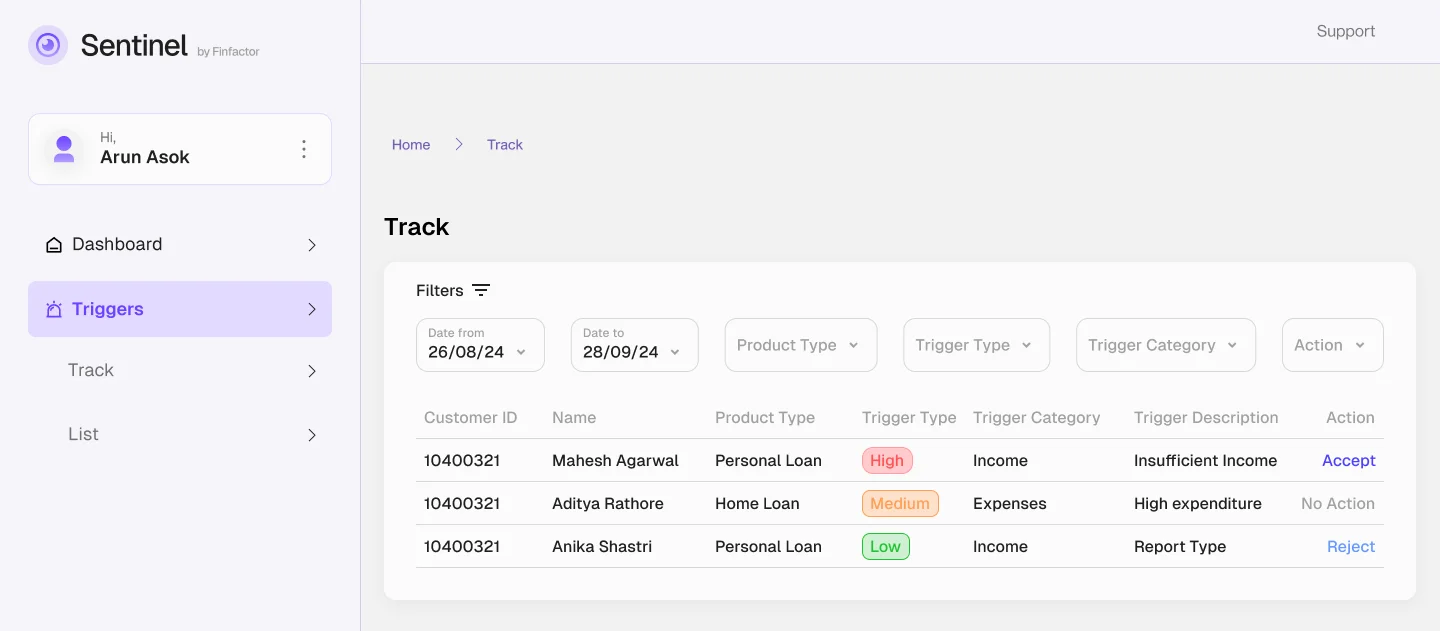

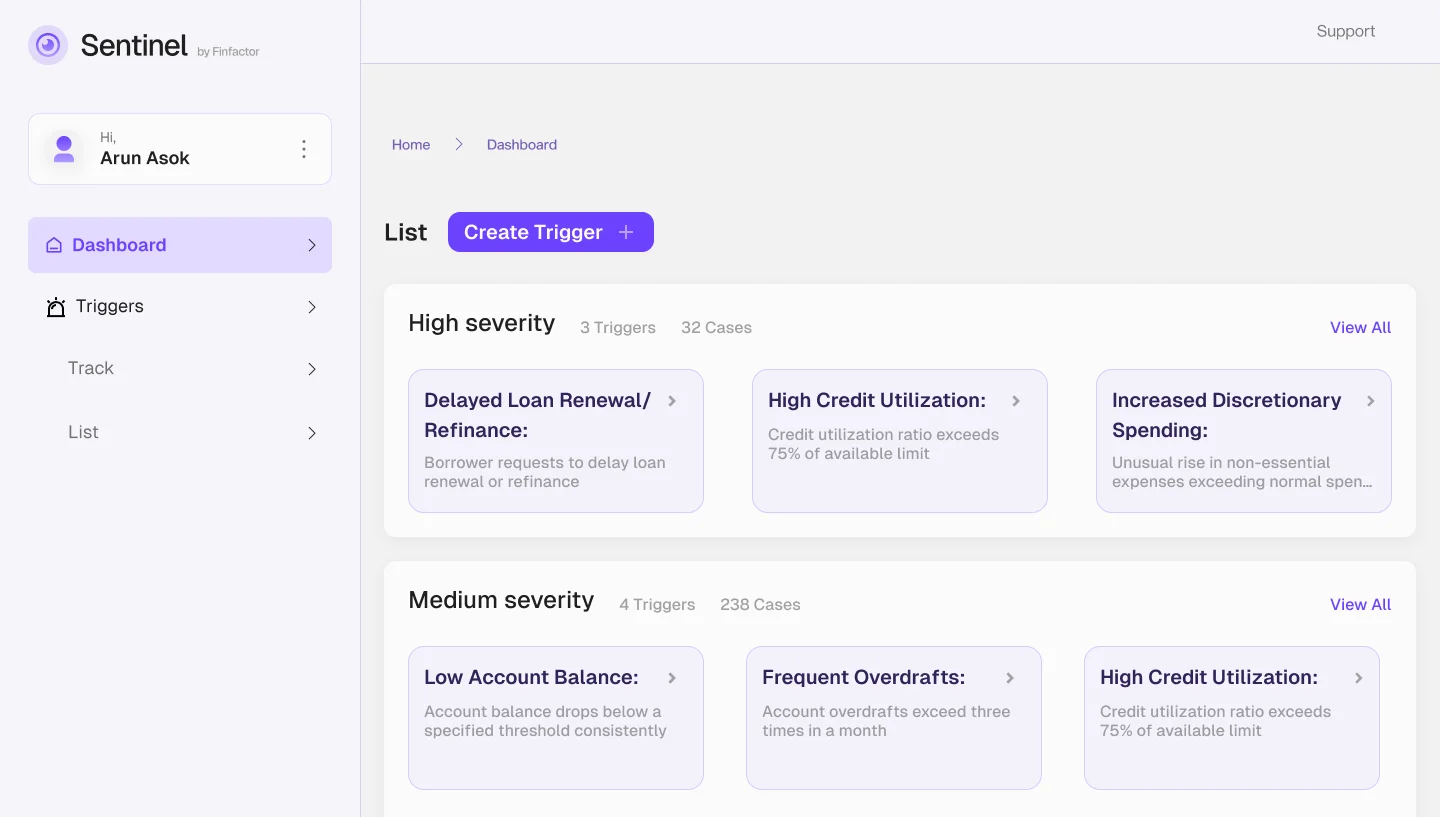

Sentinel

Proactively manage loan portfolios with smart monitoring.

Loan Underwriting

Transform your bank statements into actionable financial insights

Features

Proactive risk mitigation and improved loan recovery rates with automated

lending solutions

Our Products

Explore our smart solutions that work for you